- #Generally accepted accounting principles definition professional#

- #Generally accepted accounting principles definition free#

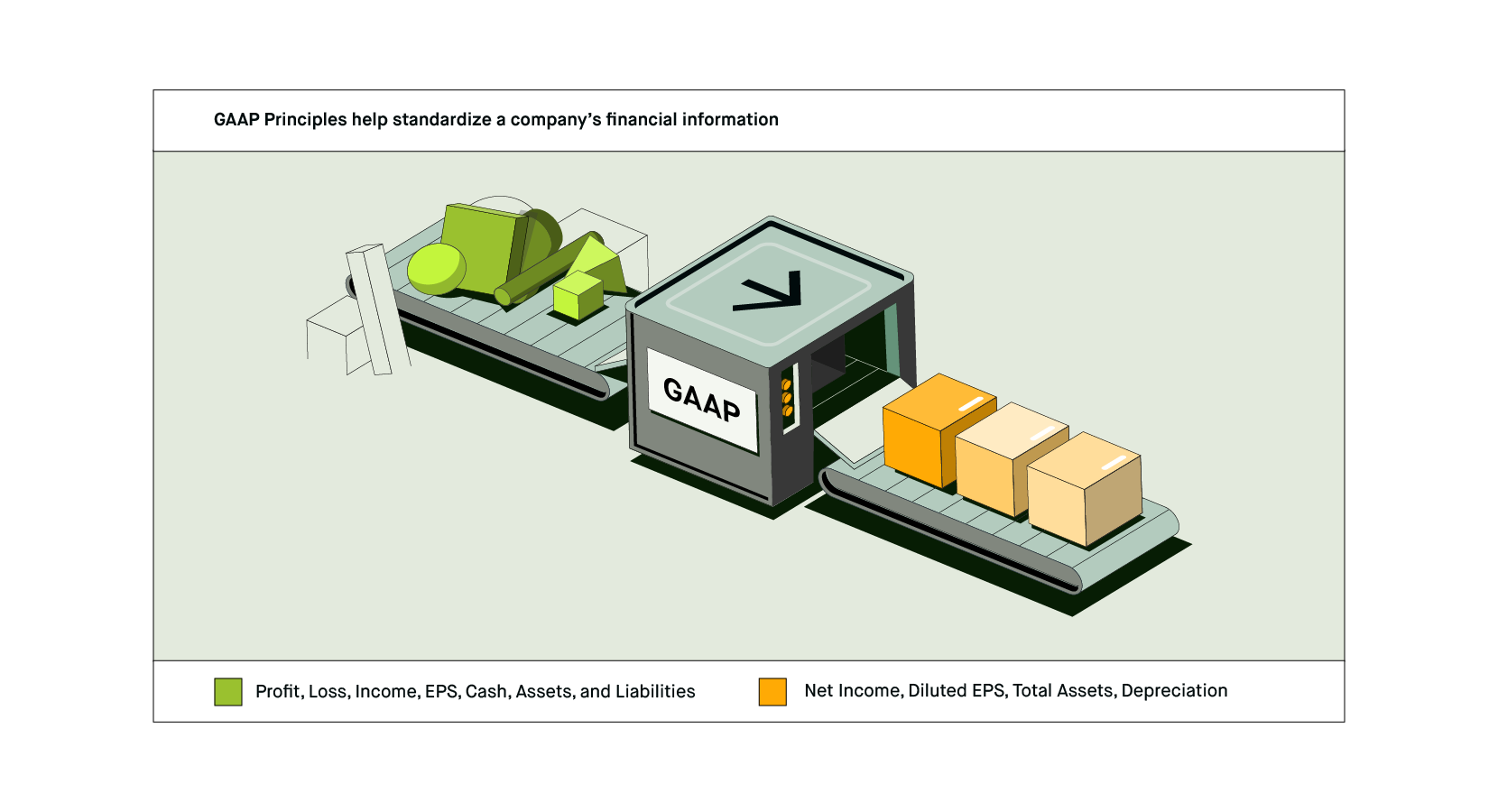

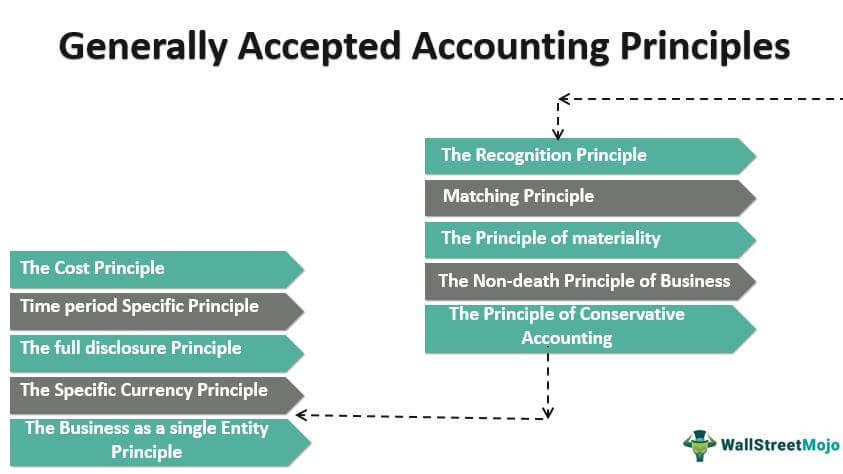

These 10 guidelines separate an organization’s transactions from the personal transactions of its owners, standardize currency units used in reports, and explicitly disclose the time periods covered by specific reports. Basic accounting principles and guidelines:.Without these rules, accountants could use misleading methods to paint a deceptive picture of a company or organization’s financial standing. These rules create consistent accounting and reporting standards, which provide prospective and existing investors with reliable methods of evaluating an organization’s financial standing. Reporting of revenues is divided by standard accounting time periods, such as fiscal quarters or fiscal years.įinancial reports fully disclose the organization’s monetary situation.Īll involved parties are assumed to be acting honestly.īeyond the 10 principles, GAAP compliance is built on three rules that eliminate misleading accounting and financial reporting practices. Speculation does not influence the reporting of financial data.Īsset valuations assume the organization’s operations will continue. GAAP-compliant accountants are committed to accuracy and impartiality.Ĭonsistent procedures are used in the preparation of all financial reports.Īll aspects of an organization’s performance, whether positive or negative, are fully reported with no prospect of debt compensation. GAAP-compliant accountants strictly adhere to established rules and regulations.Ĭonsistent standards are applied throughout the financial reporting process. law requires businesses that release financial statements to the public and companies that are publicly traded on stock exchanges and indices to follow GAAP guidelines, which incorporate 10 key concepts:

states officially require local governments to adhere to GAAP, the Governmental Accounting Standards Board (GASB) estimates that approximately 70% of county and local financial offices do anyway. Today, all 50 state governments prepare their financial reports according to GAAP. Today, the Financial Accounting Standards Board (FASB), an independent authority, continually monitors and updates GAAP. Securities and Exchange Commission (SEC) that target public companies. Federal endorsement of GAAP began with legislation like the Securities Act of 1933 and the Securities Exchange Act of 1934, laws enforced by the U.S.

#Generally accepted accounting principles definition professional#

In response, the federal government, along with professional accounting groups, set out to create standards for the ethical and accurate reporting of financial information.Īccording to Stephen Zeff in The CPA Journal, GAAP terminology was first used in 1936 by the American Institute of Accountants (AIA). The Great Depression in 1929, a financial catastrophe which caused years of hardship for millions of Americans, was primarily attributed to faulty and manipulative reporting practices among businesses. With carte blanche to portray a company’s fiscal standing in the most ideal light, investors could be easily misled.

#Generally accepted accounting principles definition free#

Without regulatory standards, companies would be free to present financial information in whichever format best suits their needs. IFRS provides general guidance for the preparation of financial statements, rather than rules for industry-specific reporting. Adopting a single set of world-wide standards simplifies accounting procedures for international countries and provides investors and auditors with a cohesive view of finances. IFRS is designed to provide a global framework for how public companies prepare and disclose their financial statements. Many countries around the world have adopted the International Financial Reporting Standards (IFRS). Publicly traded companies must comply with both SEC and GAAP requirements. The Financial Accounting Standards Board (FASB) stipulates GAAP overall and the Governmental Accounting Standards Board (GASB) stipulates GAAP for state and local government. In the United States, the Securities and Exchange Commission (SEC) mandates that financial reports adhere to GAAP requirements.

There is no universal GAAP standard and the specifics vary from one geographic location or industry to another. The purpose of GAAP is to ensure that financial reporting is transparent and consistent from one organization to another. GAAP specifications include definitions of concepts and principles, as well as industry-specific rules. The Financial Accounting Standards Board (FASB) uses GAAP as the foundation for its comprehensive set of approved accounting methods and practices.

Generally accepted accounting principles, or GAAP, are a set of rules that encompass the details, complexities, and legalities of business and corporate accounting. GAAP (Generally Accepted Accounting Principles) Abbas Shahid, Associate Taxation Advisory Services. Please read this blog and provide your valued comments.

0 kommentar(er)

0 kommentar(er)